The importance of a diversified portfolio and the investment pyramid-mitigating risk while obtaining greater profitability

When you are to invest in dentistry, make sure to have a diversified portfolio as it will help reduce risks while offering greater ROI.

It's tough to avoid risk no matter how you invest in the dental innovation fund. Most dental investors are aware that to earn larger returns, you must take more risks.

However, no one wants to take more risk than is required to attain their financial objectives. Diversification aids in risk reduction.

Some risks are taken by dental investors with the expectation of a payoff. Other risks are too unpredictable to be rewarded, and investors should avoid them. The latter is the type of risk that diversification helps investors avoid. Savvy investors avoid taking risks for which they are not compensated.

Diversify your portfolio: What does it mean for a dental investor?

The most simple and effective strategy to reduce the dental investment risk is to diversify your portfolio. To restrict exposure to any particular asset or risk, a well-diversified portfolio incorporates a variety of asset types and investment vehicles. This strategy is based on the idea that a portfolio made up of a mix of assets would, on average, have a lower portfolio risk than any existing holding or investment.

Diversification aims to smooth out unsystematic risk occurrences (non-market wide events) in a portfolio, i.e. large profits can help balance losses elsewhere. The advantages of diversifying your investment portfolio remain true only if the underlying investments in the portfolio are uncorrelated—that is, they react to market pressures differently, typically in opposing ways. Diversity is not a guarantee of loss, but most investment professionals consider it to be the most important factor in achieving long-term financial goals while managing risk.

We'll look at why this is and how you can diversify your portfolio in this blog, so you can invest in dentistry with minimal risks.

Understanding Investing Diversification

Assume you had a portfolio comprised only of healthcare stocks. Any negative news that would result in healthcare disruption may cause stock values to fall. Your portfolio's worth will drop as a result of this.

You can balance these stocks with some dental investment stocks so that only part of your portfolio is affected. These stock prices are very likely to rise as patients are looking for alternative treatments.

These companies carry risks and can be further diversified. Everything that affects healthcare hurts both companies.

You may also diversify your portfolio by investing in other asset classes. Bonds and stocks, for example, do not respond to similarly negative events. Equities and fixed income move in opposite directions, so combining a portfolio with an oral care investment will reduce market volatility in the portfolio. As a consequence, diversifying your portfolio can help you weather a storm in one area while delivering excellent outcomes in another.

Not to mention the value of being in the right place at the right time. Look for investment opportunities outside of your immediate area. Finally, investing in this region helps mitigate and offset the risk of domestic investment, as US equity and fixed income volatility can have little impact on European equity and fixed income.

Why should you diversify your investment portfolio and when should you do so?

We can't all be professional investment evaluators, and we don't all have the resources to devote our attention to the task of capital allocation. Creating an ideal plan for growing our wealth and working toward financial independence, on the other hand, is something that everyone aspires to. As a result, most long-term investors should include diversity in their investing approach.

Management of Risk

All business students are taught one of the most fundamental and prominent economic theories dealing with finance and investing by Harry Markowitz in their early years of study. The school of thinking promotes financial diversification and emphasizes the advantages of not placing all your eggs in one basket.

Investments in oral care are subject to both systematic and unsystematic risk, which includes market hazards like interest rates and recessions, as well as unsystematic risk, which includes difficulties unique to each investment, such as management changes or bad product sales.

The essential takeaway from this idea is that while good portfolio diversification cannot remove systematic risk, it may reduce, if not eliminate, unsystematic risk.

Capital preservation:

For everyone looking to invest in dental fund, money preservation should be the beginning point. Portfolio diversification can assist safeguard your resources if you're not in the capital building period of life. Some dental investors nearing retirement have goals focused on capital preservation, and portfolio diversification can help. Diversification does this by minimizing an investor's exposure to a single loss.

At all costs, avoid losses. While this may appear to be plain sense, many investors design strategies that may not effectively safeguard them from irreversible financial loss. For an investor wanting to safeguard their portfolio from losses, diversifying their investments becomes a foundation pillar.

Generating consistent returns:

Choosing dentistry investments that react differently to the same economic circumstances is at the heart of a well-diversified portfolio. A dental investor in the US won't get extraordinarily high profits from holding only one high-flying stock, but they won't have to deal with the ups and downs.

In effect, an investor earns the weighted average return on their underlying assets while avoiding complete exposure to the volatility (risk) of any given dental investment in US. This is especially true for people who have a limited investing horizon.

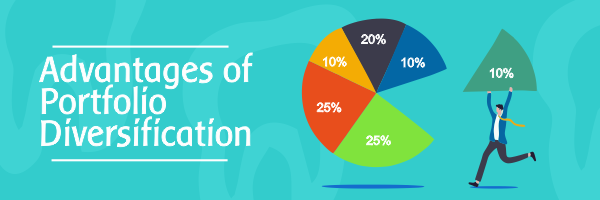

What are the advantages of Portfolio Diversification? (A Quick Outlook)

So, from the previous section, we have learned that Diversification has three major advantages:

Minimizing the risk of loss:

If an investment performance declines over a while, the performance of other assets will improve during that period, and by concentrating all assets in one place, the investment portfolio can reduce the chance of losing money.

Preserving Capital:

Diversity can help safeguard your investments if you're not in the accumulation period of life. Some investors nearing retirement have goals geared toward capital preservation, and diversification can assist.

Returns:

While investments don't always perform as planned, diversification ensures that you aren't only reliant on one source of income.

What are the Challenges in Portfolio Diversification?

Diversification is usually emphasized by professionals, however, there are certain drawbacks to this method. For starters, managing a broad portfolio, especially if you have many assets and investments, may be time-consuming.

Diversification may be costly as well. Buying and selling investment tools have an impact on your bottom line, from transaction costs to brokerage expenses. And, because increased risk entails bigger rewards, you may find that your returns are limited.

For example, many synthetic investment products, for example, have been developed to meet the risk tolerance levels of investors. These products are frequently sophisticated and therefore are not suitable for novices or small investors. Bonds are a good way to diversify against stock market risk for those with little investment skills and financial resources.

Even the most thorough examination of a company's financial statements cannot ensure that it will not be a losing venture. Diversification won't stop you from losing money, but it can help you mitigate the effects of fraud and incorrect information on your portfolio.

Unsystematic Vs Systematic risks

Every investment involves some degree of risk. Investors are frequently regarded as being rewarded for taking risks.

Some risk, however, is not rewarded. Investors must control or eliminate risks from their investment portfolio for which they are not compensated. Unsystematic and systematic risks are the two primary kinds of investment hazards.

Unsystematic risk:

The risk that is particular to a corporation is known as unsystematic risk (also known as diversifiable risk). A strike, a natural calamity such as a fire, or something as basic as sagging sales are all examples of this sort of risk. Unsystematic risk can be caused by a variety of factors, including business risk and financial risk.

Unsystematic risk and diversification:

Diversification may help a portfolio's unsystematic risk be significantly reduced. Events like the ones outlined above are unlikely to occur in every business at the same time. As a consequence, diversity can aid in risk reduction. Taking up unnecessary, irrational risk reaps no rewards.

Systematic Risks:

However, some occurrences have the potential to affect all enterprises at the same time. Inflation, conflict, and interest rate fluctuations affect the whole economy, not simply a single company or industry.

Diversification does not eliminate the possibility of these occurrences. As a result, it is classified as an un-diversifiable risk. In a well-diversified portfolio, this sort of risk accounts for the majority of the risk. It's known as systematic or market risk. The predicted profits on their investments, on the other hand, can compensate investors for tolerating systemic risks.

Dental Investors are enticed to accept risks in exchange for the possibility of bigger profits. Not all risks, however, have such high potential benefits. The prudent investor recognizes these dangers and diversifies his or her portfolio to minimize them.

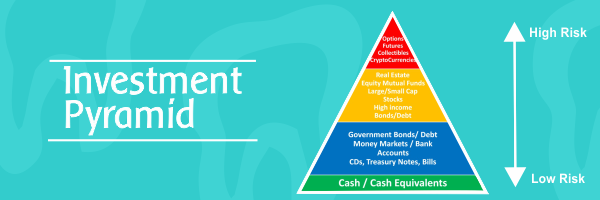

Investment Pyramid: What is it and how does it affect your investment?

A fast visual context surrounding which sorts of investments are recognized to have more or less risk or return connected with them than other investments is provided by an investment pyramid.

An investment pyramid is a 5-tiered pyramid that helps investors understand the general risk and return level of a certain investment. While an investment pyramid cannot forecast how well a particular investment would do, it can assist investors in determining which assets are most likely suitable for their risk tolerance.

An investment pyramid approach constructs a portfolio with low-risk assets at the bottom, established-company equity securities in the middle, and speculative securities at the top.

- The largest asset allocation is at the base (that is, the widest part of the pyramid), which includes cash and CDs, money market bonds, and money market products.

- A reasonable allocation to corporate bonds, equities, and real estate would be near the center of the pyramid. Such investments are a bit riskier and may lose value, but they are predicted to yield a positive return over time.

- The top allocation weights would be the smallest and would consist of very risky, speculative assets with a high risk of loss but a significant potential for above-average gains. These include derivative transactions such as options and futures (which are not utilized for hedging purposes), alternative investments, and collectibles such as artwork.

There is an increase in risk-taking inside each risk tier of the pyramid, but there is a reduced proportion of overall assets available to invest. As a result, the higher you climb the pyramid, the greater the risk, but the greater the potential return.

5 Ties in Investment Pyramid

An investment pyramid is made up of levels, with the bottom tiers having the lowest risk and the top tiers having the most risk. The number of layers in an investment pyramid is determined by the broker or financial institution that built it.

Tier 1:

The investments in the bottom rung of the investing pyramid have the lowest risk and the lowest rate of return.

Tier 2:

Low-risk, steady-return assets such as municipal and corporate bonds, preferred stock, and convertible securities make up the second rung of the investment pyramid. The second tier's assets are regarded to be fairly secure, although they are subject to the same inflation risk as to the bottom tier.

Tier 3:

Tier Three is where relatively low-risk investments with a better rate of return than the bottom two tiers may be found. Blue-chip stocks, growth funds and portfolios, balanced funds and portfolios, and variable annuities are all included in this category. While these investments are regarded to be generally stable, they provide a higher rate of return than those in categories one and two.

Tier 4:

It is the highest tier where the equities and stock funds, including large-, mid-, and small-cap stocks, are found in tier four. Small- and mid-cap equities carry a higher risk than large-cap stocks. This tier also includes mutual funds, which allow investors to participate in numerous firms at once by purchasing a single fund.

Tier 5:

The riskiest assets are situated at the very top of the investing pyramid; options, futures, speculative stocks, and bonds are all found here. The return, like the loss, may be substantial.

Investment Pyramid: What are the Pros and Cons of this strategy?

Pros are explained as follows:

A decent primer on investing risk levels is:

An investing pyramid is a useful tool for rapidly learning which assets are considered riskier than others.

Clears things up:

The investing pyramid might help you evaluate and contrast your possibilities if you're having trouble deciding how to invest your money in dental investment funds.

The Drawbacks are:

You make the ultimate investment decision and are responsible for any risks:

The investing pyramid is more of an instructional tool; you'll be the one to make the ultimate decision about how to invest your money, and you'll be the one to bear all of the risks.

Nuance is missing:

The investing pyramid can offer you a basic understanding of which sorts of investments have historically been riskier and more likely to provide high returns, but it ignores the fact that every investment is different.

Portfolio Diversification and Investment Pyramid: The Bottom line

Diversification can help with risk management and reduce the volatility of an asset's price fluctuations. However, no matter how well diversified your portfolio is, risk can never be completely avoided.

You can reduce the risk associated with individual shares, but broader market risks affect almost every stock, so diversification across asset classes is also important. The goal is to find a happy medium between risk and profit. This way, the dental investor will be able to meet your financial objectives while still enjoying a decent night's sleep.

The investment pyramid can help dental investors who are new to investing and aren't ready to employ an investment adviser figure out what types of assets are appropriate for their risk level. However, merely glancing at an investing pyramid will not help you make an informed decision on how to invest your money. You should also conduct your study into any investment opportunity you're thinking about.

To achieve your long-term objectives, you must strike a balance between risk and return. Choosing the correct mix of dental investments and then rebalancing and evaluating your portfolio regularly may make a significant difference in your results.

As an investor becomes more experienced, their financial objectives shift, as does their risk tolerance. A cautious strategy would necessitate an investor's portfolio to be adjusted accordingly. Review your strategy at least once a year, or anytime your financial circumstances or goals change, to ensure that it still makes sense.

To learn more about the Dental Innovation Fund, reach out to us at contact@dentalinnovation.fund or visit our website https://dentalinnovation.fund/